are assisted living expenses tax deductible irs

But did you know some of those costs may be tax deductible. Assisted living facilities primarily help residents with non-medical needs.

Tax Deductions For Assisted Living

Although minor and infrequent medical services such as first-aid for a wound can sometimes be met on-site by nurses.

. The letter explains the types of conditions that would meet the standards in order to qualify these costs as tax deductible. To qualify the long-term care services must involve personal care services such as. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care services on your taxeswith some qualifications and restrictions of course.

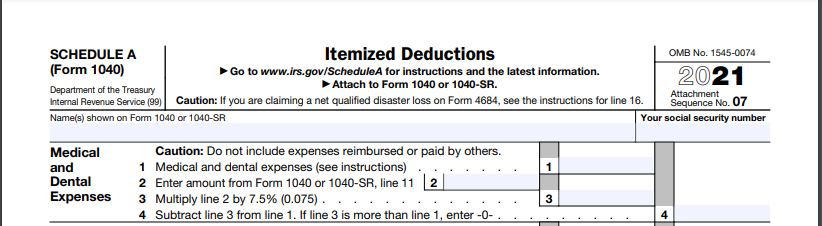

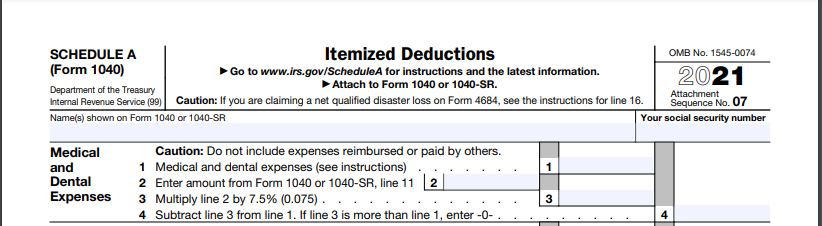

As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075 or 75. So if your total medical expenses are 50000 only expenses exceeding 3750 would be eligible for a deduction. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses. If that individual is in a home primarily for non-medical reasons then only the cost of.

A private letter from the Internal Revenue Service explains that meals and lodging costs for an assisted living stay may be deducted as medical expenses if the individual is in the facility for qualifying medical reasons. The Internal Revenue Service IRS rules for assisted living expenses are laid out in IRS Publication 502 Medical and Dental Expenses. Your spouse or another dependent can qualify as a deductible expense on your taxes.

For taxpayers under the age of 65 medical expenses must exceed 10 of your adjusted gross income. The full list of medical expenses that qualify for a tax deduction can be found on page 23 of the IRS Tax Guide for Seniors and in IRS Publication 502. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

See the following from IRS Publication 502. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

Individuals in assisted care or relatives supporting dependents in assisted living facilities can usually deduct some health care expenses as long as the sick individual meets certain qualifications. Tax Deductions for Assisted Living Expenses. Long-Term Care Assisted Living Deductions Any long-term care services such as assisted living nursing home care and in-home skilled nursing services can be deducted as medical costs under certain circumstances.

Yes in certain instances nursing home expenses are deductible medical expenses. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. Which means a doctor or nurse with diagnosing abilities has stated that the.

If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense. A TurboTax QA meanwhile explains that assisted living expenses are tax deductible when the patient cant care for themselves as certified by a licensed healthcare practitioner. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

Much of the uncertainty stems from the challenge of determining what portion of a seniors monthly fees are considered medical care. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible.

Tax deductions are the perfect example. Deducting Assisted Living Expenses Long-term care services are tax-deductible expenses on Schedule A according to the 1996 Health Insurance Portability Accountability Act HIPAA. John properly filed his 2020 income tax return.

Qualified long-term care services have been defined as including the type of daily personal care services provided to Assisted Living residents such as help with bathing dressing continence. Assisted Living Expenses and Tax Deductions While some families arent aware that they may be entitled to a tax deduction others who do know about it find the process too confusing to navigate. If you and your spouse are over the age of 65 you can deduct medical expenses that exceed 75 of your adjusted gross income.

Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible.

To qualify for cost-of-living deductions there must be a plan of care prepared listing all of the services that the resident will receive to qualify for the deduction. Chronic Illness and Tax Deductible Status. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill.

But did you know some of those costs may be tax deductible. To qualify for this tax break expenses need to be itemized. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A.

Tax And Accounting Services Tax Deductions Tax Services Tax Accountant

Individual Income Tax Return 2011 Departamento De

Advisory Committee On Tax Exempt And Government Entities Act

When Can In Home Care Be Deducted As A Medical Expense Life Plan Resource

The Irs And Incontinence Supplies Home Care Delivered

10 Creative But Legal Tax Deductions Howstuffworks

Download W2 Form 2015 5 Tips To Help Work Travel Usa Participants File 2014 Tax Time Power Of Attorney Form Form

What Tax Deductions Are Available For Assisted Living Expenses

Is Drug Rehab Tax Deductible Writing Off My Addiction Treatment

Are Medical Expenses Tax Deductible

Once You File Your Tax Return Consider These 3 Issues

What Is A W 9 Tax Form H R Block

Can In Home Care Expenses Be Written Off On Taxes

Irs Reveals 2022 Long Term Care Tax Deduction Amounts And Hsa Contribution Limits Ltc News

Did You Pay Medical Expenses In 2021 New Rule For Medical Deductions West Ridge Accounting Services

Irs Announces That Face Masks And Related Purchases Are Tax Deductible